Video Source: How To Pay Yourself As An LLC Posted: 5/11/21

Video Source: How To Pay Yourself As An LLC Posted: 5/11/21

When you start a business, one of the first questions you might have is: “How do I actually pay myself?”

It sounds simple, but if you do it wrong, you can end up paying a lot more taxes than you should. In this post, we’re going to break down everything Karlton Dennis teaches about how to pay yourself correctly if you own a Single Member LLC — and what happens if you don’t.

This guide will help you avoid unnecessary taxes, protect your business, and even show you how to level up to the next stage when you start making real money.

What Karlton Dennis Is Saying: Understanding the Single Member LLC

Karlton starts by explaining that when you create a Single Member LLC, you’ve technically built what the IRS calls a “disregarded entity.”

Definition: A disregarded entity just means that the IRS sees your business and you as the same thing for tax purposes — even though you have separated your liability.

Liability means responsibility for debt or legal problems.

By setting up an LLC, you’ve protected your personal life (your car, your house, your savings) from business lawsuits or debt.

Even though the IRS sees your taxes together, you now have a separate EIN number — basically a social security number for your business.

You take that EIN to the bank and open a business bank account.

That step is important because it keeps your personal money and your business money separated. (If you mix them up, it can destroy your legal protections.)

How to Pay Yourself as a Single Member LLC

Karlton explains this clearly:

Once you have your LLC set up and your business bank account open, you can accept payments for your business (let’s say you sell candles and make $100,000).

Now you want to move some money from your business account to your personal account.

How do you do that?

You simply transfer the money — either by writing yourself a check, transferring money online, or even using an app like Venmo.

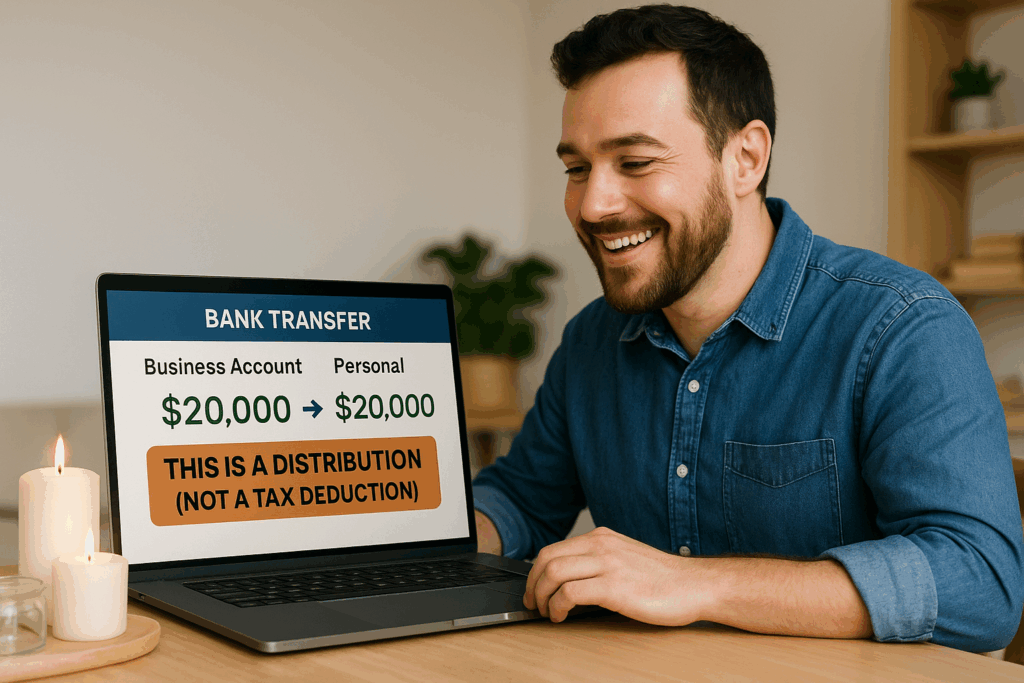

This is called a distribution.

Definition: A distribution is when you move profits from your business account to your personal account without running payroll.

👉 But here’s the catch:

When you move money this way (a distribution), you do not get a tax deduction for it.

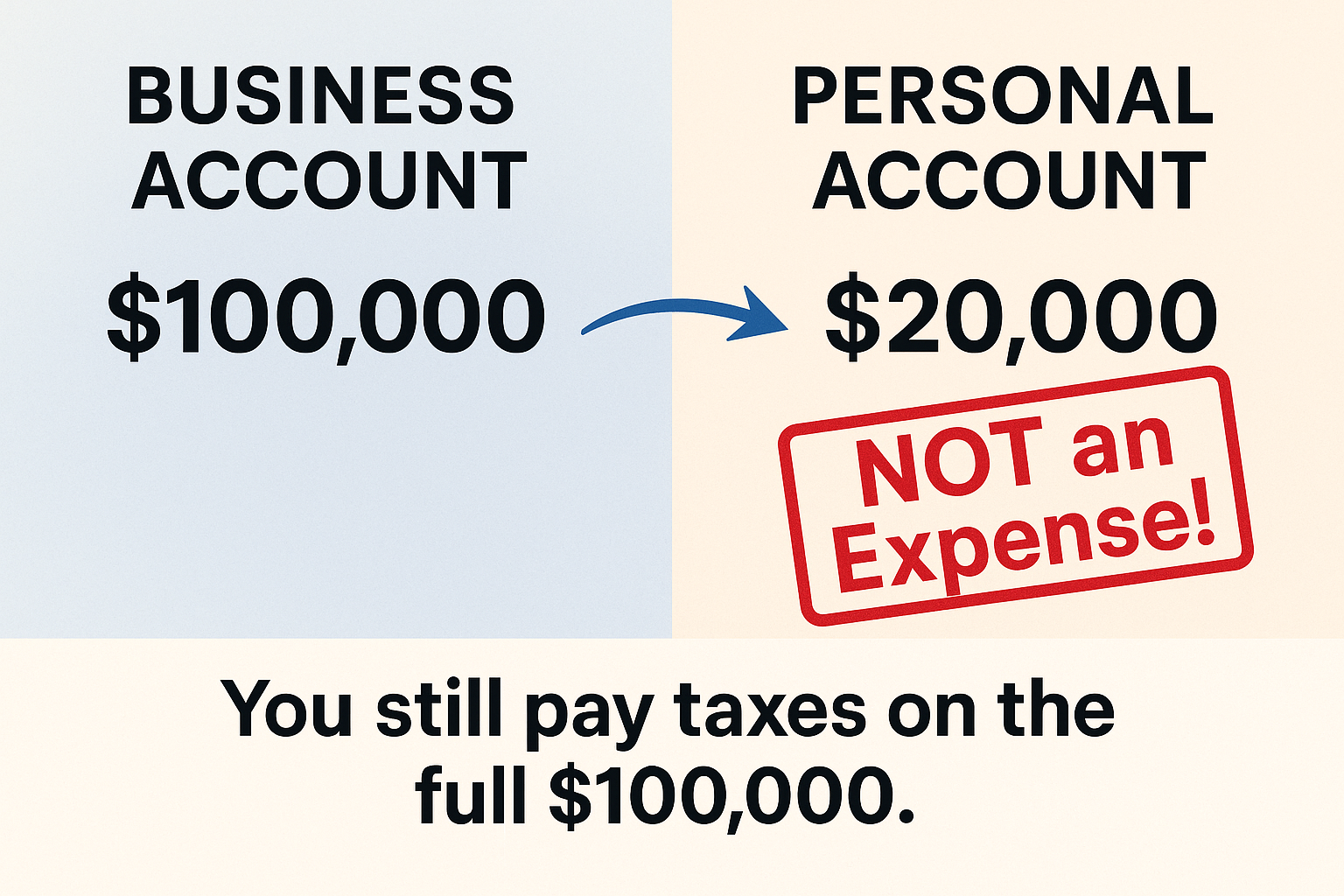

Scenario:

- Your candle business made $100,000.

- You moved $20,000 to your personal account.

- You still pay taxes as if you earned $100,000, because giving yourself $20,000 wasn’t considered an “expense” that reduces your taxes.

That’s the big downside of staying a Single Member LLC.

Why Single Member LLCs Can Hurt You Long-Term

Karlton says this is where many people mess up:

- They grow their business.

- They start paying themselves.

- But they realize they’re not getting any tax savings.

- They get hit with a massive tax bill because of something called self-employment tax.

Definition:

Self-Employment Tax = 15.3% extra tax (for Social Security and Medicare) that business owners must pay on all their profits.

So, if you made $100,000, you would owe $15,300 just for self-employment tax — before even paying regular income taxes.

What Karlton Recommends: Switch to an S Corporation (S Corp)

If your business starts making real money (more than $30,000–$50,000 a year), Karlton highly recommends electing to become an S Corporation.

This sounds complicated, but it basically means you tell the IRS:

“I still own an LLC, but now I want to be taxed like a corporation.”

How to switch:

- File IRS Forms 2553 and 8832.

- You should do this with a tax professional to make sure it’s done right.

What’s the benefit?

Once you’re an S Corp, you are allowed to pay yourself a salary — like an employee — and the rest of the business profits come to you differently.

You save a ton on taxes by:

✅ Only paying Social Security and Medicare taxes (FICA) on your salary

✅ NOT paying self-employment tax on the business profits

Reasonable Compensation: How Much Should You Pay Yourself?

Karlton explains that as an S Corp owner, you have to pay yourself a reasonable salary.

Reasonable just means what someone doing your kind of work would normally be paid.

Scenario:

- Your candle business grosses $300,000.

- After expenses, your business’s net income (profit) is $100,000.

- Karlton’s rule of thumb: Pay yourself at least 30% of the net income.

So you might pay yourself $30,000 as a salary.

You would pay regular payroll taxes (7.65%) on that $30,000, but not on the other $70,000 in profits.

You also get something called a QBI deduction (Qualified Business Income deduction) — a 20% bonus deduction on business income you didn’t pay yourself.

Definition:

QBI Deduction = A 20% tax break on business income from an LLC or S Corp that you didn’t pay yourself as wages.

Karlton’s Example: Comparing Taxes LLC vs. S Corp

| Situation | Single Member LLC | S Corporation |

|---|---|---|

| Business Profit | $100,000 | $100,000 |

| Self-Employment Tax | $15,300 | $0 on profits |

| Salary Tax | N/A | Only on $30,000 salary |

| Federal & State Income Tax | Higher | Lower |

| Net Savings | Smaller | MUCH Bigger |

In numbers:

- As a Single Member LLC: You might pay nearly $40,000 in taxes total.

- As an S Corp: You might pay only about $28,000.

That’s a $12,000 savings — just by switching how your business is taxed.

A Cool Tip Karlton Shared About Payroll

Karlton said you do NOT have to run payroll every month if you don’t want to.

You can do one payroll at the end of the year once you know your real profits.

This helps you manage cash flow better and plan smarter — instead of stressing every month.

Tips & Resources Mentioned

- Tool: EIN (Employer Identification Number) — Needed to open your business bank account and separate your business identity.

- Tool: Payroll Service (ADP, Gusto, etc.) — Helps you run your salary correctly once you switch to an S Corp.

- Resource: IRS Forms 2553 and 8832 — Needed to elect S Corp status for your LLC.

- Mindset Tip:

“Self-employment tax can kill your wealth if you don’t plan. Protect your business early.”

Final Thoughts

If you’re starting a business, how you pay yourself matters more than you think.

Set up your LLC the right way, know when it’s time to switch to an S Corp, and use the tax laws to your advantage.

Karlton makes it clear: the government actually gives you tools to pay less tax — but it’s up to you to learn how to use them.

Make sure to check out Karlton Dennis’s full video for even deeper explanations if you’re serious about building your business the smart way!

If you found this helpful:

Share this with a friend who’s thinking of starting their own business!

Bookmark this post so you can refer back when setting up your LLC

Leave a comment: What’s one thing you learned about taxes today?